By Catherine Austin Fitts

My “go to” website for technical analysis of precious metals, the US dollar & the US stock market is Rambus Chartology, where Rambus (that’s his handle – he’s the founding technical analyst) leads a discussion with extensive charts of what the markets are saying.

In January 2016, Rambus launched his quarterly Solari Report with a Blockbuster Chartology. You can find links to the entire series of quarterly and annual Blockbuster Chartologies at the end of this latest piece.

One of the reasons that Rambus is so good at his craft is that he focuses on “staying on the right side of the major trend.” The challenge of doing so at this time is that it is tempting to look for bottoms or to assume that the trend upwards in the US dollar or stock market may be over. However, Rambus consistently brings us back to the discipline of the Chartology. What does price tell us? As he describes so aptly, we are dealing with psychological warfare.

Sitting back once each quarter to get this perspective offers invaluable insight. So, here we go for the 1st Quarter 2020 Blockbuster Chartology!

Blockbuster Chartology Quarterly Report

By Rambus

~ 1st Quarter 2020 Wrap Up ~

There is a lot that has happened since the last Quarterly Report. We experienced one of the strongest short term declines in history for the US stock markets and the Coronavirus that will be talked about for many decades into the future. We also had a major breakout in the precious metals complex except for silver with the commodities in general tanking hard to the downside.

The 2020 stock market crash will be talked about a 100 years from now just like we talk about the Great Depression now. The great debate now is what is going to happen next. I sense the majority of investors are looking at the 1929 scenario to play out with another Great Depressing now upon us. The other scenario floating around is that we just witnessed something like the 1987 crash, which still has the biggest one day decline on a percentage basis in history of about 23% or so. Below is a weekly look at the price action leading up to the 1929 crash. This chart also shows you how human nature never changes by the same chart patterns that were formed back then, are the same chart patterns we see today almost a 100 years later.

Whenever you see a rising pattern where the top and bottom trendlines are slopping up you know you are in a strong trending market. As you can see there was a bullish rising wedge and the bullish expanding rising wedge that formed during the heart of the bull market. Then just before the 1929 top was reached the INDU formed an expanding triangle which is considered to be a pattern where investors are losing control of their emotions as the swings start getting bigger and bigger in both directions.

The roaring 20’s came to an end when the INDU put in a fairly small H&S top related to the size of the bull market. The initial breakout from the 1929 H&S top took only 4 weeks before to complete before the last countertrend rally, bearish rising wedge, really set the stage for the greatest decline for the INDU in history.

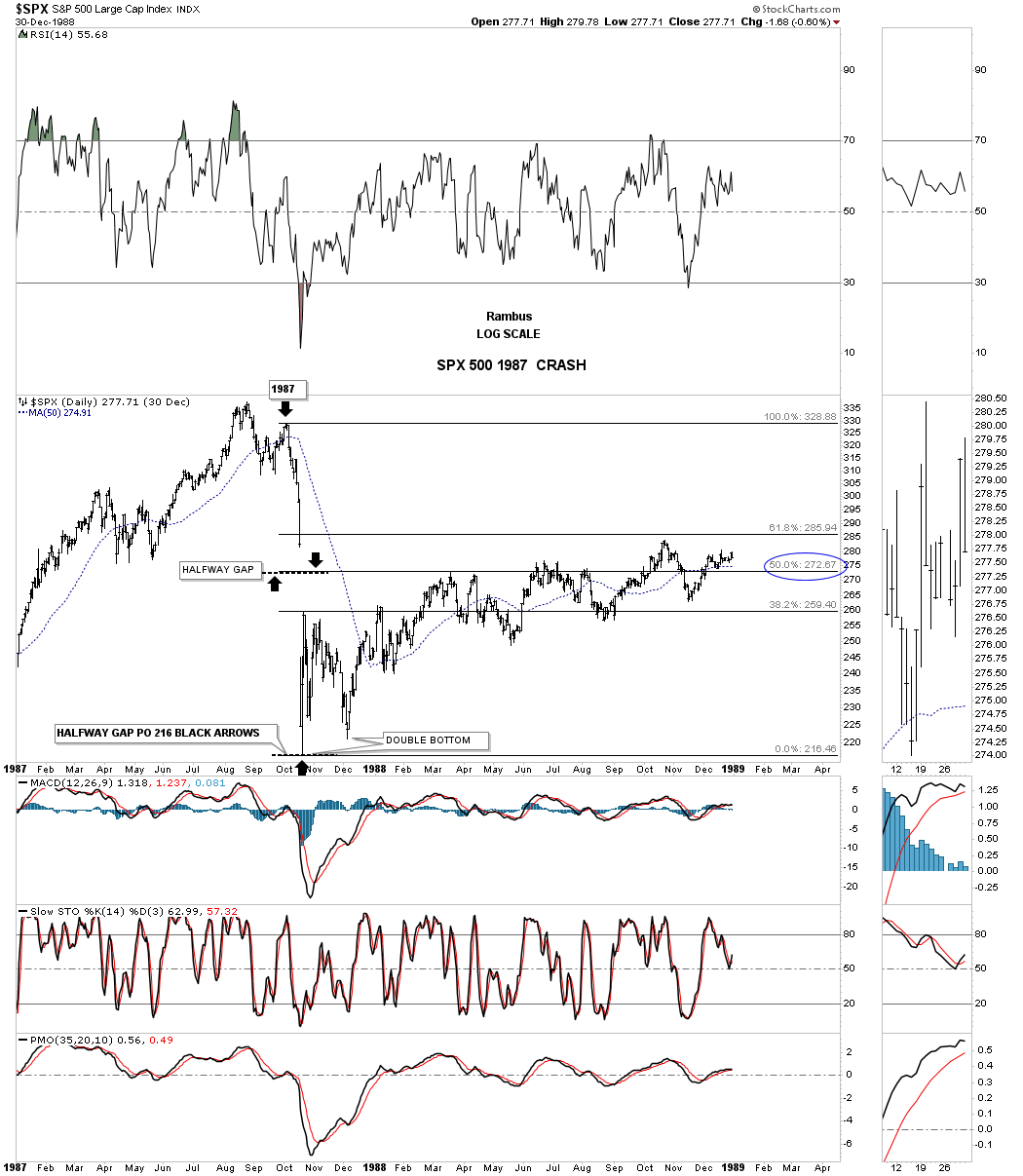

This next chart is 2 year daily chart for the SPX which shows the 1987 crash and what took place afterwords. After putting in the crash low on the left side of the double bottom the SPX traded sideways below the 38% retrace but never put in a lower low. Normally after a hard crash like this and the one we just experienced in 2020 the price action can stay range bound for a long period of time before the major trend can reassert itself again. There was a chart pattern that formed during the 1987 crash that looks very similar to the one that was made this year during the 2020 crash.

Note the big gap that was made on the way down that formed right in the middle of the crash which is called a halfway gap or breakaway gap. You can get a price objective by measuring from the last reversal point before the crash to the middle of the gap. You add that distance from the middle of the gap to get your price objective which was 216.

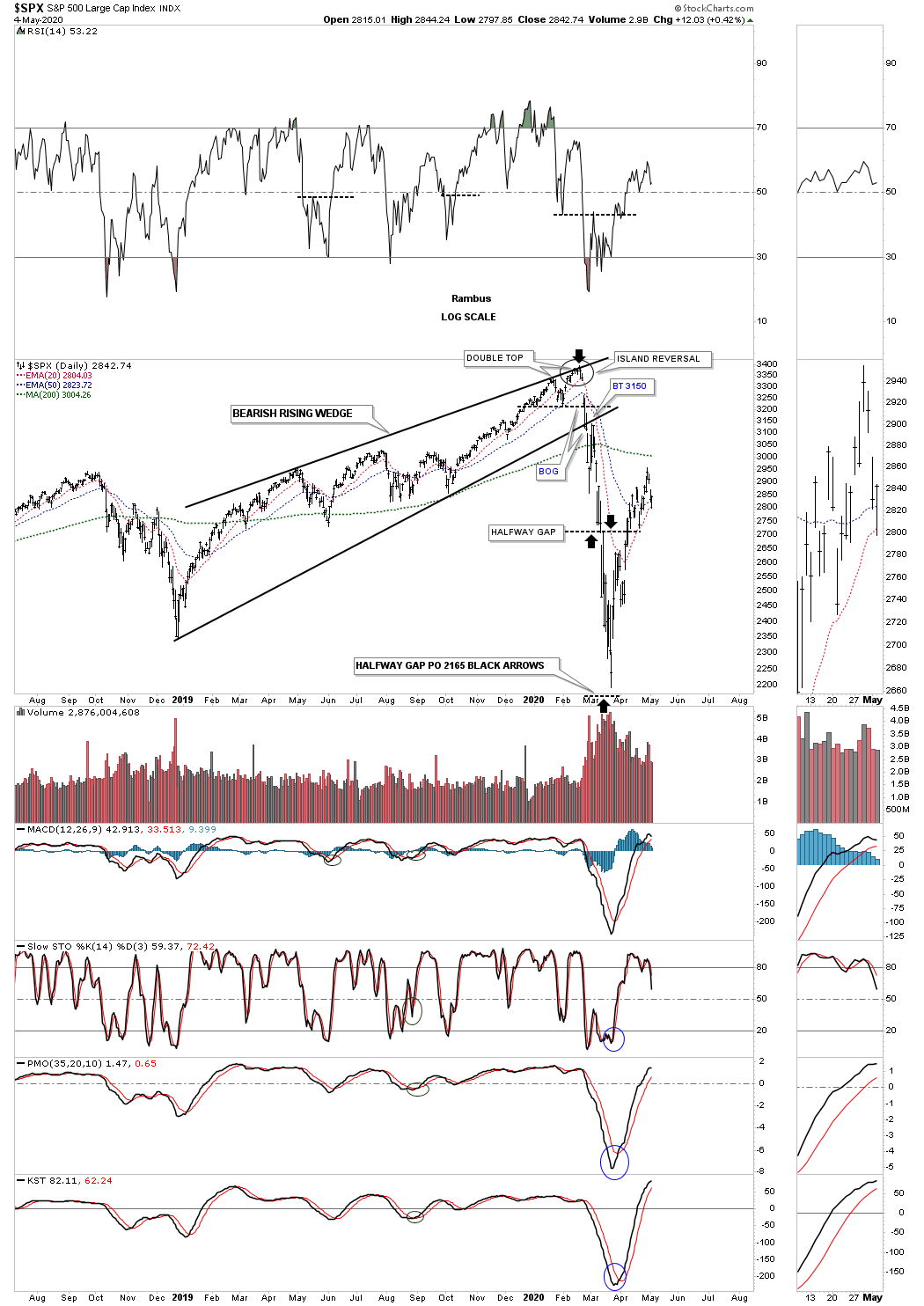

This next chart for the SPX shows the 2020 crash and how similar it is to the 1987 crash. Note the same setup to the 1987 crash by taking the last high, measuring down to the halfway gap which isn’t as pronounced as some of the other US stock markets, taking that distance and adding it to the middle of the gap to get your price objective down to the 2165 area as shown by the black arrows.

There is one more important bit of information on this chart I would like to show you. Anyone who has been following me for any length of time knows I was extremely bullish going into the all time high made on February 19th, 2020. Even on that day there was nothing on the chart to tell me that a disaster of major consequences would soon be upon us. The first real clue I got was when I recognized the small Island Reversal which isn’t that big of a deal but a short term negative. Then when the SPX dropped below the previous low a warning bell went off to look for a possible double top formation which is a reversal pattern. The breakout gap below the bottom rail of the 2019 rising wedge was my point to exit the bull market and wait for more information. At that time I mentioned that if the now bearish rising wedge played out as it should we could see a waterfall decline to where the rising wedge began to form in December of 2018. I really didn’t expect to see one of the greatest declines in history to follow but that is what happened. The reason I’m showing you this chart is because when the Chartology changes so do I, regardless of what I may think. Never underestimate the power of a reversal pattern no matter how big or how small it may be. We were able to avoid most of the crash by getting out early and actually made some money on the way down especially on the short oil trade.

Currently I’m neutral in regards to which way the major trend is eventually going to take hold. Until then I’m going to let the dust settle for a bit. In the meantime, below are a couple of rules I live by which may not make sense to some investors but makes total sense to me.

Let me start by saying, “The only rule when it comes to trading the stock markets is, “There Are No Rules.” The other important rule that I live by is that, “the markets are always right regardless of what I think.” It’s interesting to hear comments like, the markets don’t trade like they use to so its not any fun anymore. Even trading during the mania phase in the tech bubble parabolic rise wasn’t easy, or the markets can’t keep going up because of no volume or interest rates are too high or countless other reasons that only make sense according to traditional investing.

I personally fight everyday to keep an open mind to any possible scenario that may arise even if it doesn’t seem possible. I would venture to say that 90% of our members think I’m off the deep end because I believe there is a possibility that the 2020 crash low may already be in place and a new bull market could be setting up. How many are simply amazed by the strength the stock markets are showing? How can it keep going up with all the negative news about the Coronavirus and what its doing to the US and world economies.

Chartology is the study of chart patterns and human emotions which make up those chart patterns that are formed each and everyday. I’ve often said that we are playing a game of psychological warfare more than anything else. When the herd is moving one way it is very difficult as a human to move in the opposite direction because that’s our nature for survival. That works great in the real world but not so much when it comes to trading the stock markets.

I’v tried just about every trading discipline there is but I’ve always come back to building chart patterns and trying to interpret their meaning. From a Chartology perspective all the information an investor needs is in the charts. All the charts we look at everyday are made up from actual investors, institutions, mom and pop, the risk taker or the conservative trader with their hard earned capital on the line. It’s their view on the fundamentals or technicals or whatever it is that makes them want to invest in that stock that makes it go up or down.

The bottom line is that when a market or stock doesn’t do what you think it should be doing don’t blame it on the stock or the market because they are always right. It’s our interpretation of the information that is flawed. It can be a hard pill to swallow but that’s the nature of the game we choose to play. If it was easy everyone would be a millionaire, but then there would be no markets to trade.

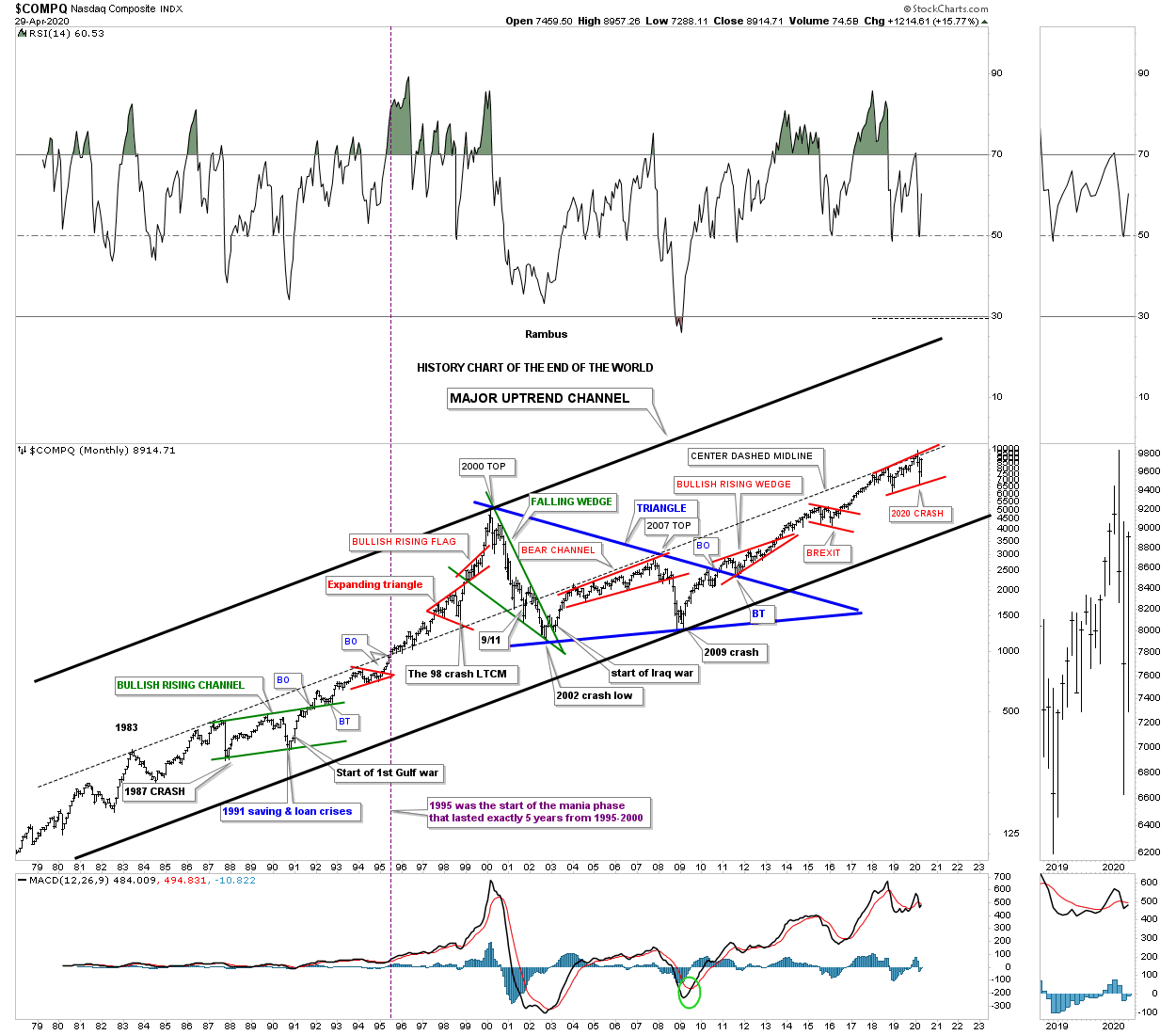

Last month when the 2020 crash put in the initial bottom I posted the, History Chart For the End of the World, that goes back to 1979. This historical chart shows all the end of the world events that I have personally traded through. I won’t go into a lot of detail since we just looked at this chart last month but for new members just start at the 1987 crash low which literally felt like the end of the world and is still the biggest one day decline in history on a percentage basis. Then just work your way to the right to see all the other history making events and chart patterns that felt like the end of the world when they occurred.

I view the center dashed midline as the most important line on this chart. It stretches all the way back to 1983 and kept the secular bull market in check until it came time for the tech parabolic move to take off beginning in 1995. In 1995 the price action was finally able to trade above the center dashed midline. With no overhead resistance the sky was the limit. After the 2000 top was in place the bear market crossed back below the center dashed midline once again where it turned back into resistance until the infamous 2007 top which led to one of the strongest bear markets in history. Since the 2009 crash low, which felt like the end of the world, its been very difficult for many investors to believe one of the biggest bull markets in history has occurred. Ask yourself a simple question. How much of the 2009 bull market have you actually felt comfortable trading, if any? How many reasons have you read that the rally was living on borrowed time or the fundamentals were sooo bad that there was no way the rally could continue.

So here we are again at another very important inflection point in regards to the 2020 crash low. Is this time going to be different and the end of the world is now upon us or are we witnessing another historical buying point? Note the small red rising flag that is forming just below the center dashed midline that is getting close to completing its 4th reversal point. We will get our answer if the top rail of the red rising flag and the center dashed midline are finally broken to the upside. Could we then see something similar to what we saw back in 1995 when the tech stocks went parabolic for 5 years? History has taught me not to bet against it.

Precious Metals Complex:

There are as many ways to play the PM sector as there are investors. Some will only buy the big cap PM stocks for safety. Others will only buy the mid cap producers. Some will only buy a mix of big caps and mid cap producers. And then there are the PM stock investors that will only play the juniors. Each has its own advantage depending on your risk tolerance. Some of you are wondering why is Rambus’s portfolio structured like it is with hardly any big caps miners?

After a great run during the tech bull market that ended in 2000 I was able to basically retire and build our dream home. After that bull market ended I was left looking for another area in which to invest. It wasn’t until early 2002 that I saw a chart for gold which was showing a very large base that caught my attention. Whenever I see a big base I have to study it more to see what is behind the price action. The more I looked, it became apparent to me, that a new bull market may be starting to form in the PM complex.

Keep in mind I knew very little about the PM complex back then as I only traded the big cap tech stocks. I only knew a few of the really big cap PM stocks like Newmont, Barrick, ASA and just a couple of others. I didn’t even know there was a sector called the juniors. It didn’t take long, after I immersed myself in studying all I could about this new area to invest, that I became hooked. I still remember my first trades in the PM sector which were Newmont, Barrick and ASA.

I kept studying this new and exciting area for me and found out about the juniors and the possibilities they could offer. I read several articles about how many of the juniors went through the roof in 1997 I believe, when BRE-X supposedly found the Mother Lode. Juniors were going up 100’s of percent and many going up 1000’s of percent. There are few areas in the markets that a sector can go up that much so I had to study more. The more I studied this little sector the more convinced I became, that for me, this is where I wanted to trade. The rest they say is history.

I already had the foundation for identifying chart patterns so it was just a matter of finding as many juniors as I could and look at their chart patterns. Since the first leg up in the new bull market had ended there were many juniors with some decent consolidation patterns already in place. I was lucky that I was able to catch most of the 2nd leg up in the new bull market before it ran out of gas and needed to consolidate its gains. When I put my first PM portfolio together I bought 10 juniors all under a dollar and hoped for the best. By the time the correction began that portfolio was up 273% in just under 8 months which was more than I had hoped for.

During the next impulse move up that began in 2005 I had bought 20 juniors all under a $1.00 and when that impulse move ended that portfolio was up 328% in less than a year. Needless to say I had found a new home in which to trade.

What I learned trading back then was that the tide would lift all boats to a certain degree with the juniors, that had good looking chart patterns, 100’s of percent. What I also learned back then was that when the impulse move ended it was time to get out of those juniors as they could give back a large chunk of the profits during the next consolidation phase.

So that brings us up to my current portfolio. One thing about the PM stocks is that it is a small universe and following it through the years you begin to learn about their individual characteristics and how they may behave during an impulse move. Some would call my current portfolio very speculative because I don’t have any really large PM stocks, but I do have a decent mix of some mid caps and juniors.

Sir Plunger’s 4 horsemen are going to do very well and make a lot of money for those that invest in those 4 stocks. For me personally and what I learned in the first half of this secular bull market that ended in 2011 was that the juniors is where I want to mostly trade. If I don’t make at least 250% to 300% on this trade, which I finished up the buying several weeks ago, then I will be disappointed. I hope it will be more but I’ll be satisfied with the 250% to 300% profits.

Another important lesson I would like to share is that once you are in a confirmed impulse move the last thing you want to do is try trading it. That was a lesson I learned the hard way though the years. For whatever reasons once you get out of a trade in an impulse move the idea that you are going to buy back at a cheaper price very seldom works out. My experience has been you usually pay up if you want to get that position back.

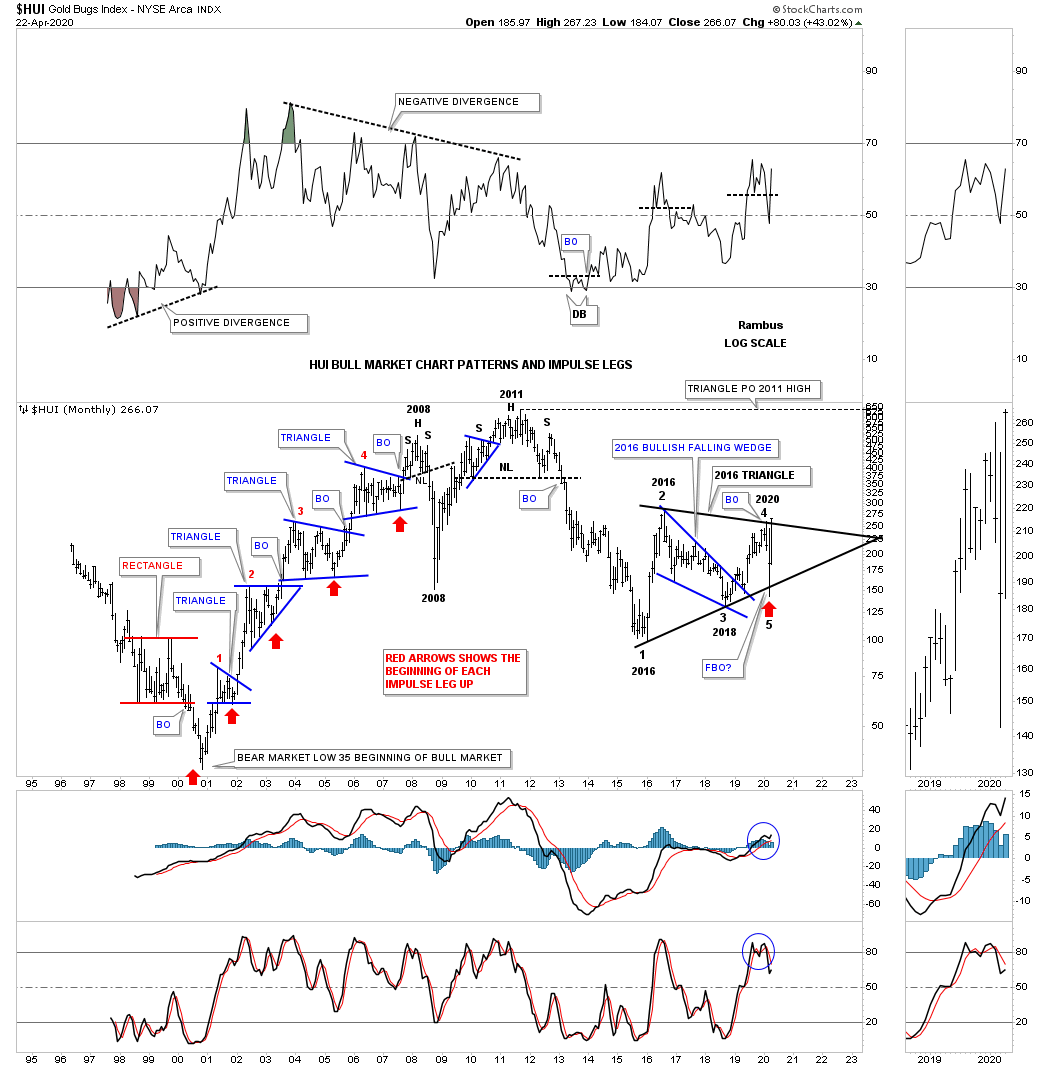

I posted this history chart for the HUI several weeks ago which shows all the consolidation patterns that formed during the first half of the secular bull market that ended in 2011. The red arrows show you where the impulse move actually began. As you can see most of the impulse moves between each consolidation pattern lasted for many months before they became exhausted. If you recall the last time I posted this chart I put the red arrow under the 5th reversal point on the 2016 triangle reversal pattern. I said I wasn’t going to wait for the breakout before I got positioned which so far has worked out well. The price objective for the 2016 triangle is above the 2011 all time high over 700 but I’ll be satisfied to reach the all time high before the next consolidation period begins.

So how does the 2016 triangle reversal pattern look on the long term secular bull market uptrend channel? It has been forming right on the bottom rail of the 2000 bull market uptrend channel. Where will the HUI be trading if the top rail of the bull market uptrend channel is reached in the future?

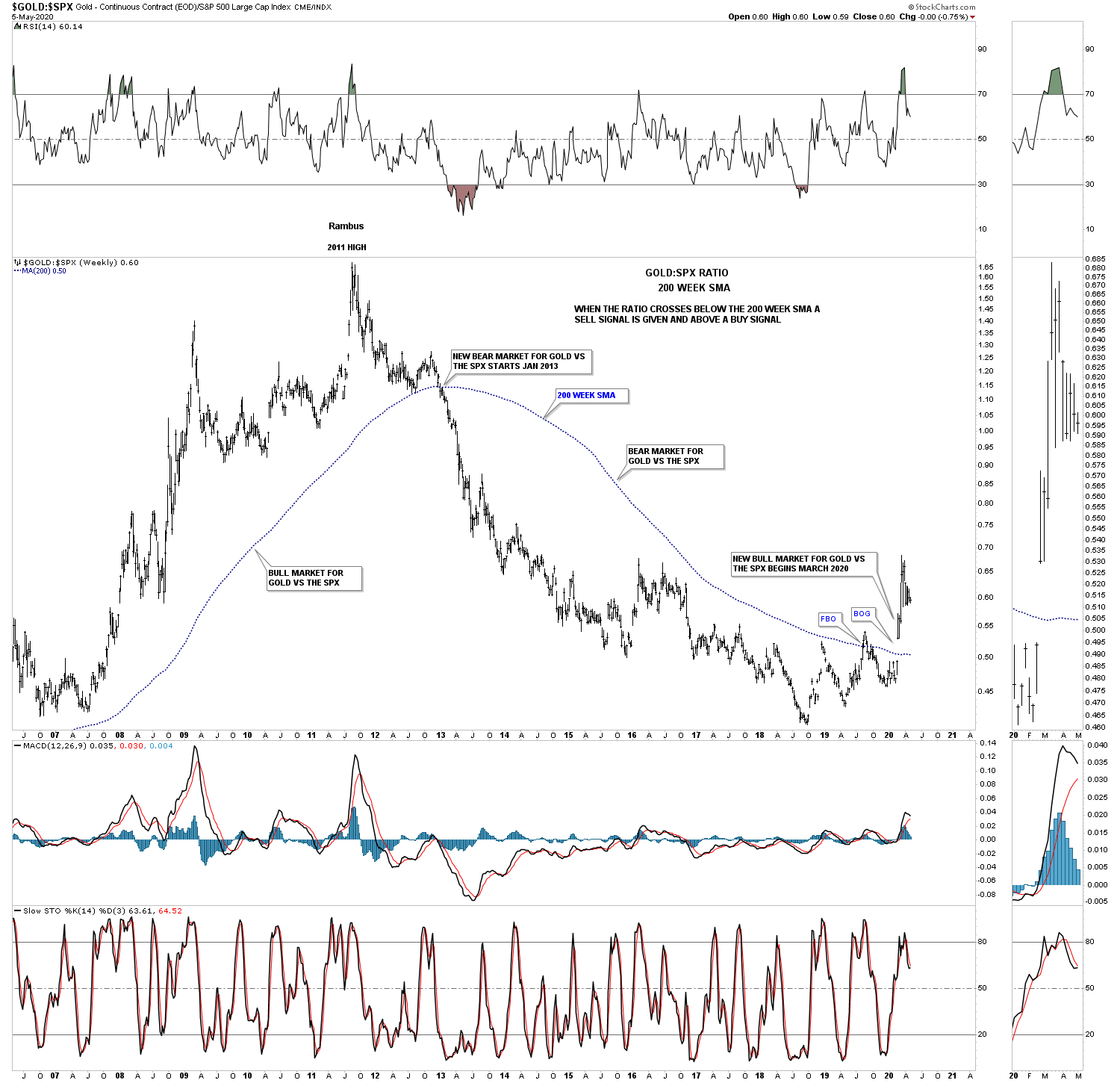

This next chart is a ratio chart that compares GOLD:SPX which gives long term buy and sell signals. When the ratio trades above the 200 week sma a long term buy signal is given and when the price action trades below the 200 week sma you are on a long term sell signal. Recently in March of this year the ratio finally broke out above the 200 week sma giving a brand new buy signal. The previous bear market sell signal occurred in January of 2013 over 7 years ago. This chart tells us gold is now set to outperform the SPX until the next sell signal is generated.

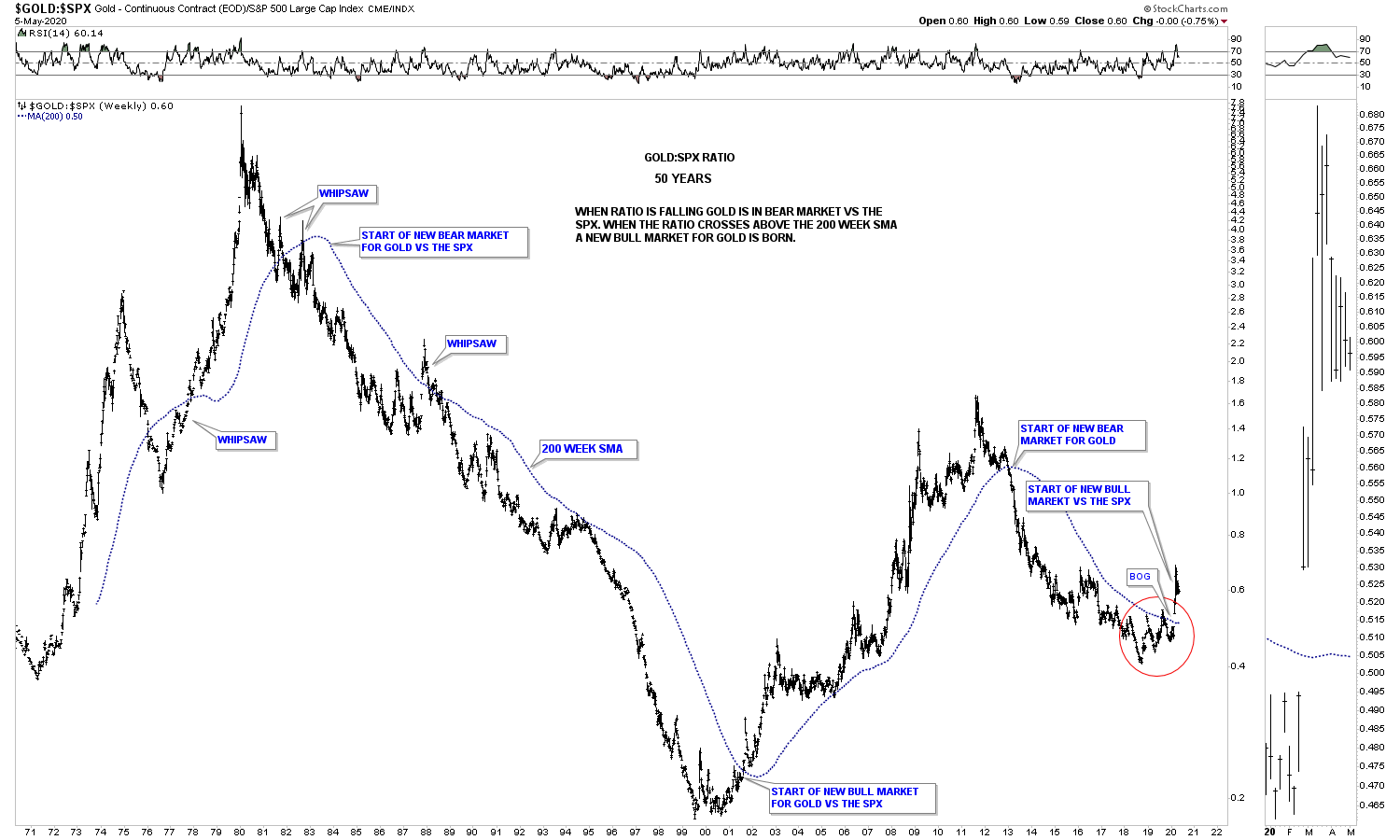

This next chart is the same as the one above but his chart goes back 50 years and shows all the long term buy and sell signals. As you can see once the dominate trend gets established it can last for many years. In over 50 years there has only been 3 whipsaws where the ratio traded over the 200 week sma only to trade back below it.

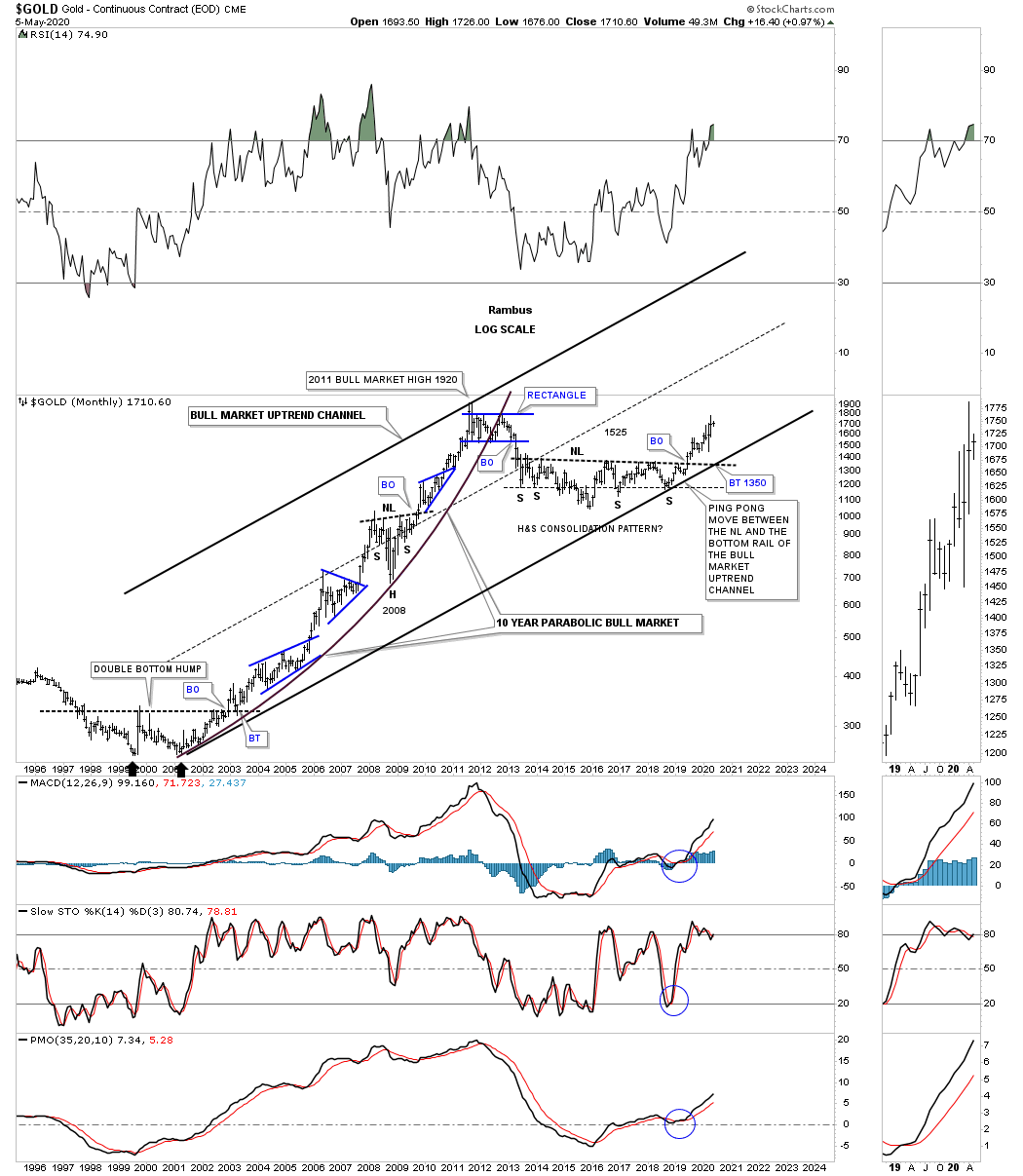

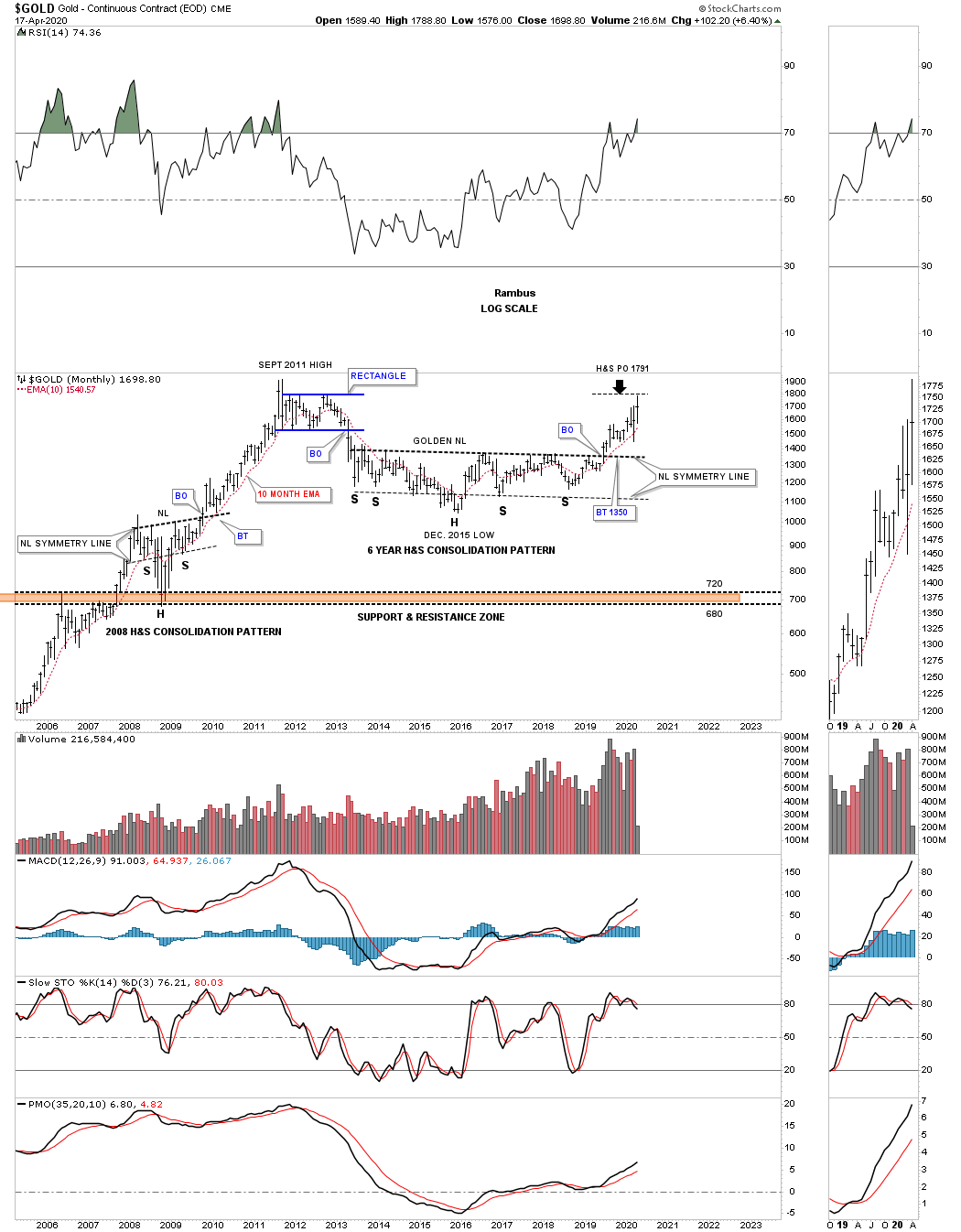

For those that want to see what a secular bull market looks like this long term month chart for gold shows the first phase of the secular bull market that ran from 2000 to 2011. Gold has been correcting the first leg up for almost 9 years now building out the massive 6 year H&S consolidation pattern. The 6 year H&S consolidation pattern could very well end up being a halfway pattern between the first leg up and the current leg up. Note the blue consolidation patterns that formed during the first bull phase and how each one of those blue patterns formed about the halfway point between each impulse move.

There is one subtle bit of Chartology on this long term monthly chart that is easy to see if you look for it. In any strong uptrend you will see higher highs and higher lows that is by definition an uptrend and just the opposite for a downtrend. If you start at the double bottom that launched the 2000 – 2011 bull market follow the price action starting at the right side double bottom as shown by the black arrow. Follow each monthly low all the way up to the 2008 H&S consolidation pattern. Not once during that entire move did we see gold make a lower low. During the formation of the 2008 H&S consolidation pattern we did see gold make a lower low which formed the head. Now follow the price action from the head of the 2008 H&S consolidation pattern up to the all time high made in September of 2011 and you will see higher lows all the way up.

Commodities:

After a long term bear market in most commodity related stocks we are starting to hear analyst talk about inflation. From a Chartology perspective the deflationary scenario is still in play but how much lower can this sector go? In tonights Weekend Report, I’m going to update some long term commodity charts we’ve been following for years to see where they are currently trading in their bear cycle.

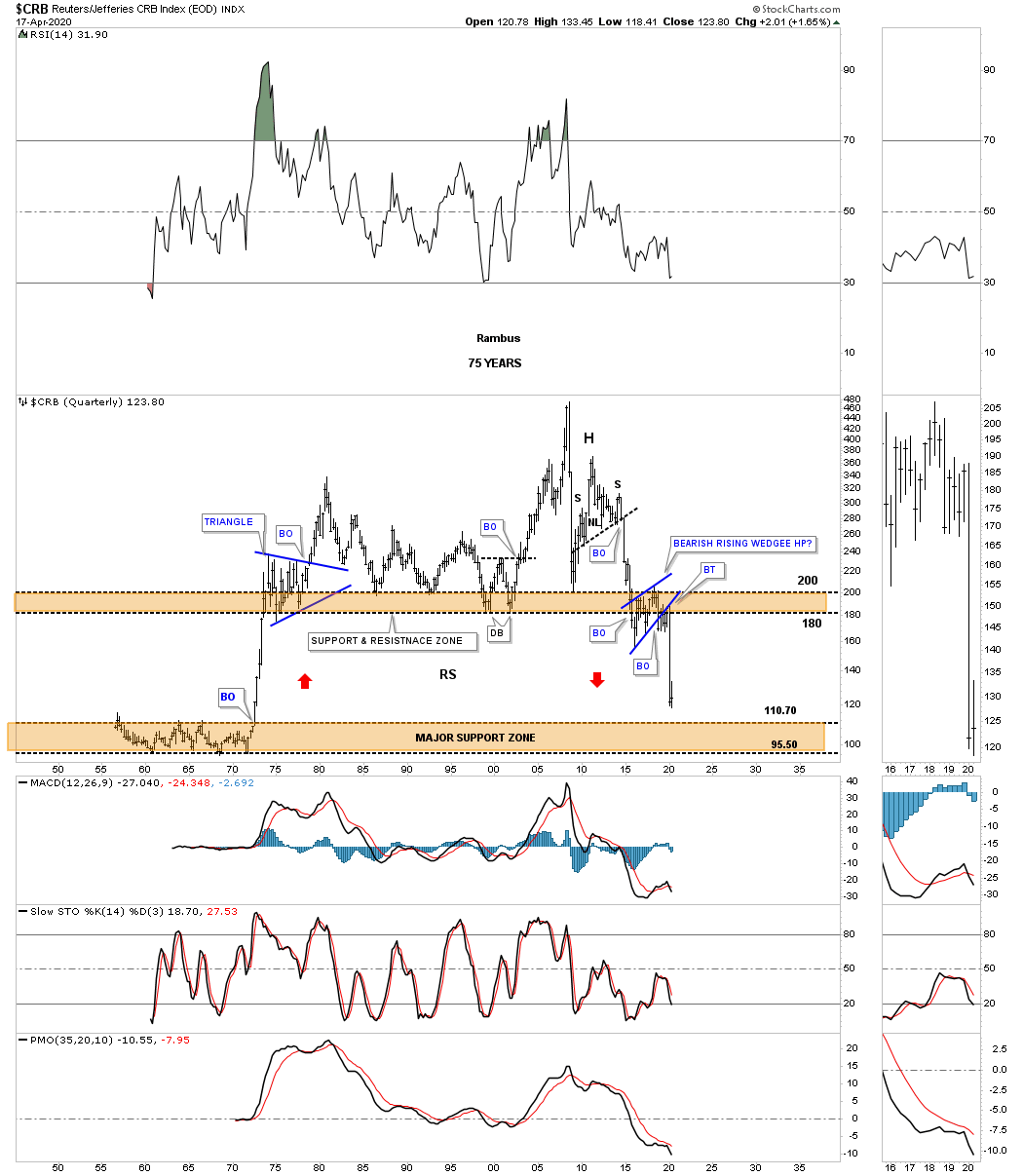

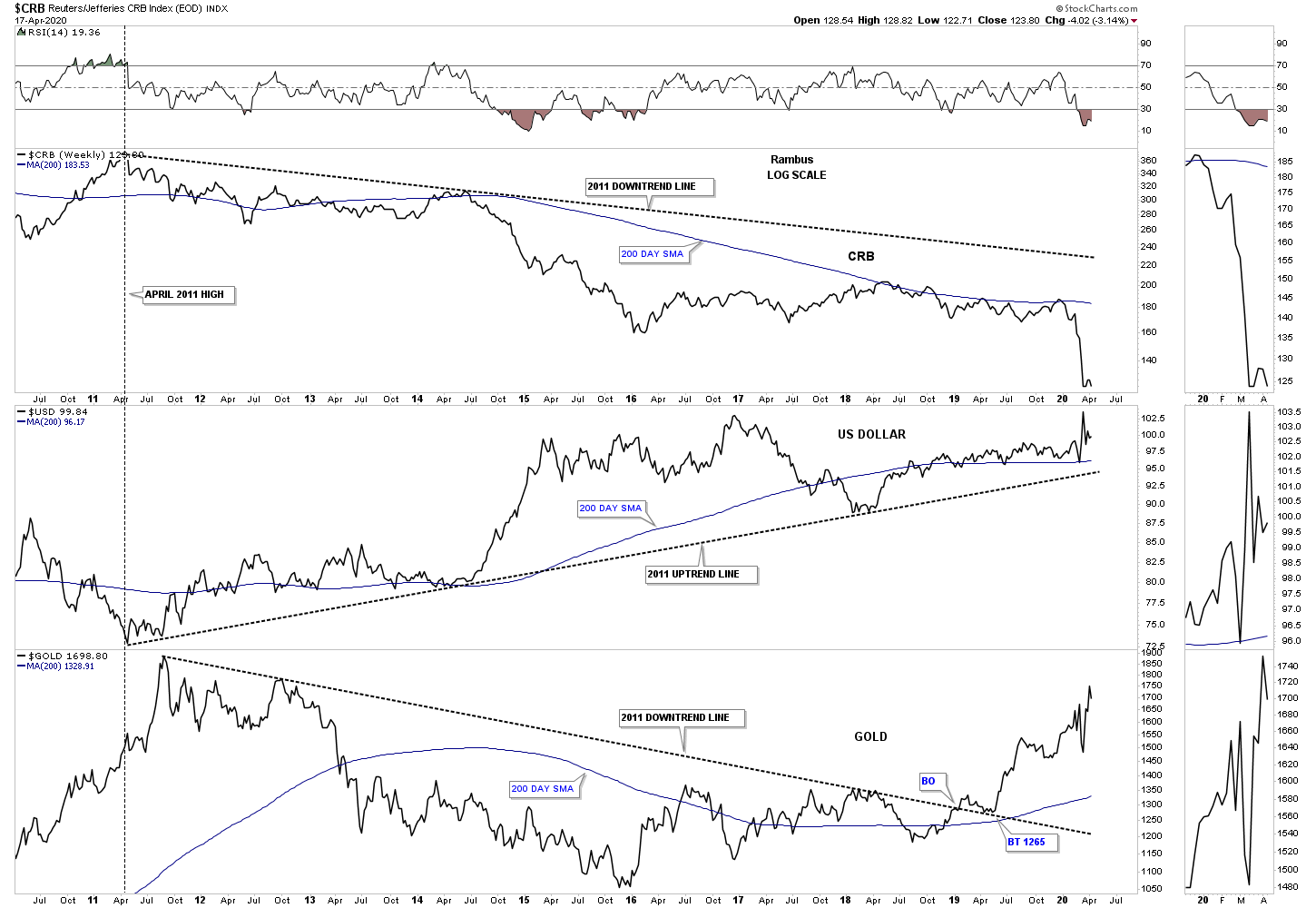

Lets begin by looking at one of the most widely followed commodity indexes the CRB. This 20 year monthly chart clearly shows the bear market began in July of 2008 which puts the age of its bear market at 12 years and counting. The initial crash, out of the 2008 high, was the same crash that the stock markets and PM complex experienced. The countertrend rally out of the 2009 crash low setup the next important high in the ongoing bear market which was the 5 year H&S consolidation pattern. The impulse move out of that 5 year H&S consolidation pattern took the CRB index down to the January 2016 low where we saw another countertrend rally that concluded in May of 2018 forming the head of the 4 year H&S consolidation pattern. The H&S neckline gave way in February of this year and has reached the minimum H&S price objective at 134.23. The CRB index has now reached an important point within its impulse move down where we could see either another small consolidation pattern start forming, similar to the blue expanding triangle halfway pattern in 2005, or some type of reversal pattern.

This is what I wrote back on August 23, 2019. This next chart for the CRB index is the infamous 75 year quarterly chart which shows the trading range that formed between the mid 1950’s to the early 1970’s. This chart shows how the H&S top and the bearish rising wedge fits into the big picture which could have serious negative consequences for the CRB index. If the current bearish rising wedge fulfills its measured move as a halfway pattern to the downside the CRB index will be trading all the way down into the brown shaded support zone using the BO to BO method. Just measure from the breakout below the neckline to the first reversal point in the 2016 bearish rising wedge. Then just take that measurement and add it to the breakout point of the 2016 bearish rising wedge to get your price objective. As you can see the current price action is now approaching the top of the brown shaded support zone which goes all the way back to the mid 1970’s.

This next chart is a long term weekly combo chart which has the CRB index on top, with the US dollar in the middle and gold on the bottom. Since 2011 the CRB index has been moving inversely to the US dollar while gold has been moving generally up with the US dollar since the 2016 low. At this point a strong US dollar is still playing havoc with the commodities in general but not so much for gold.

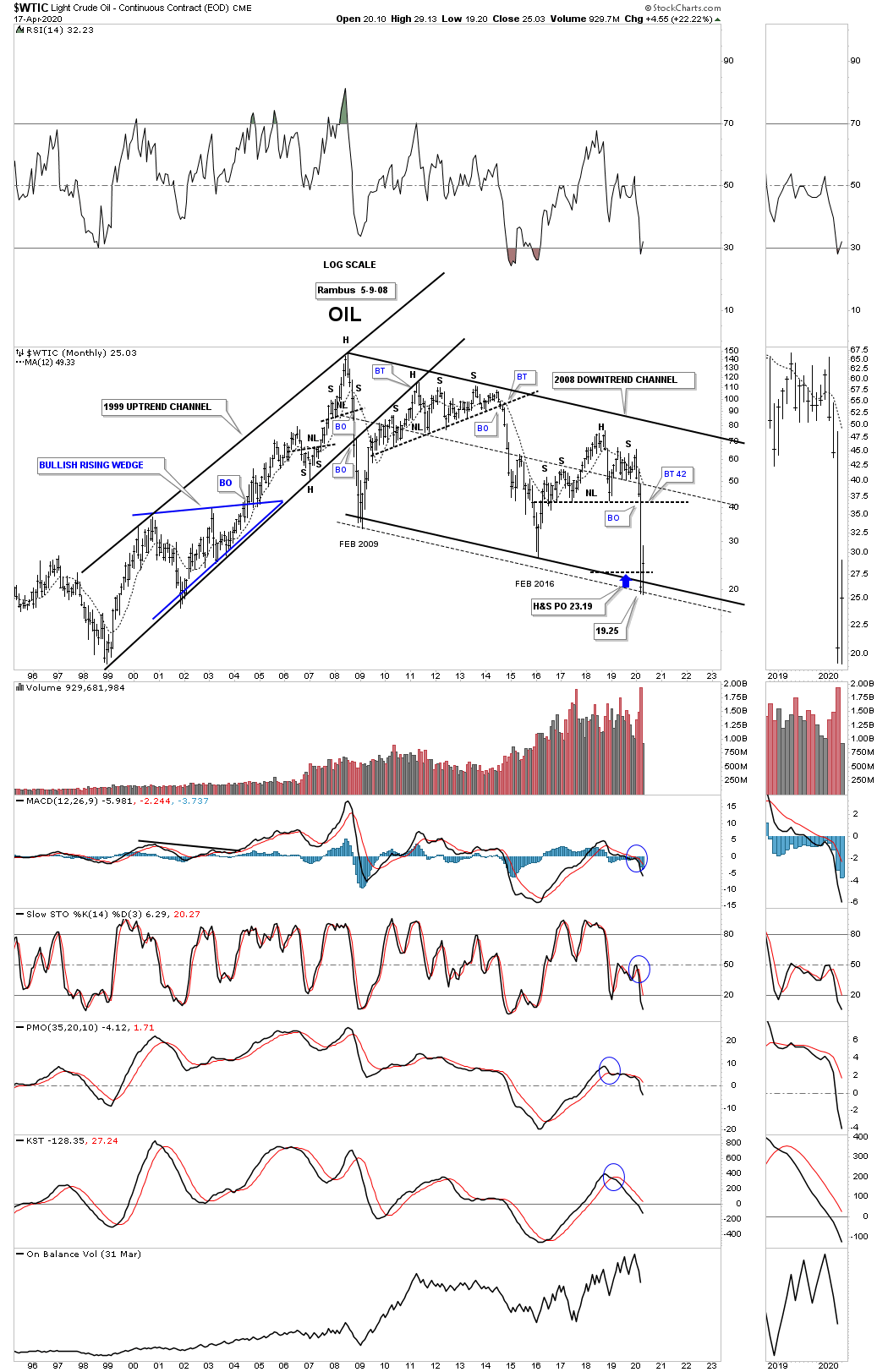

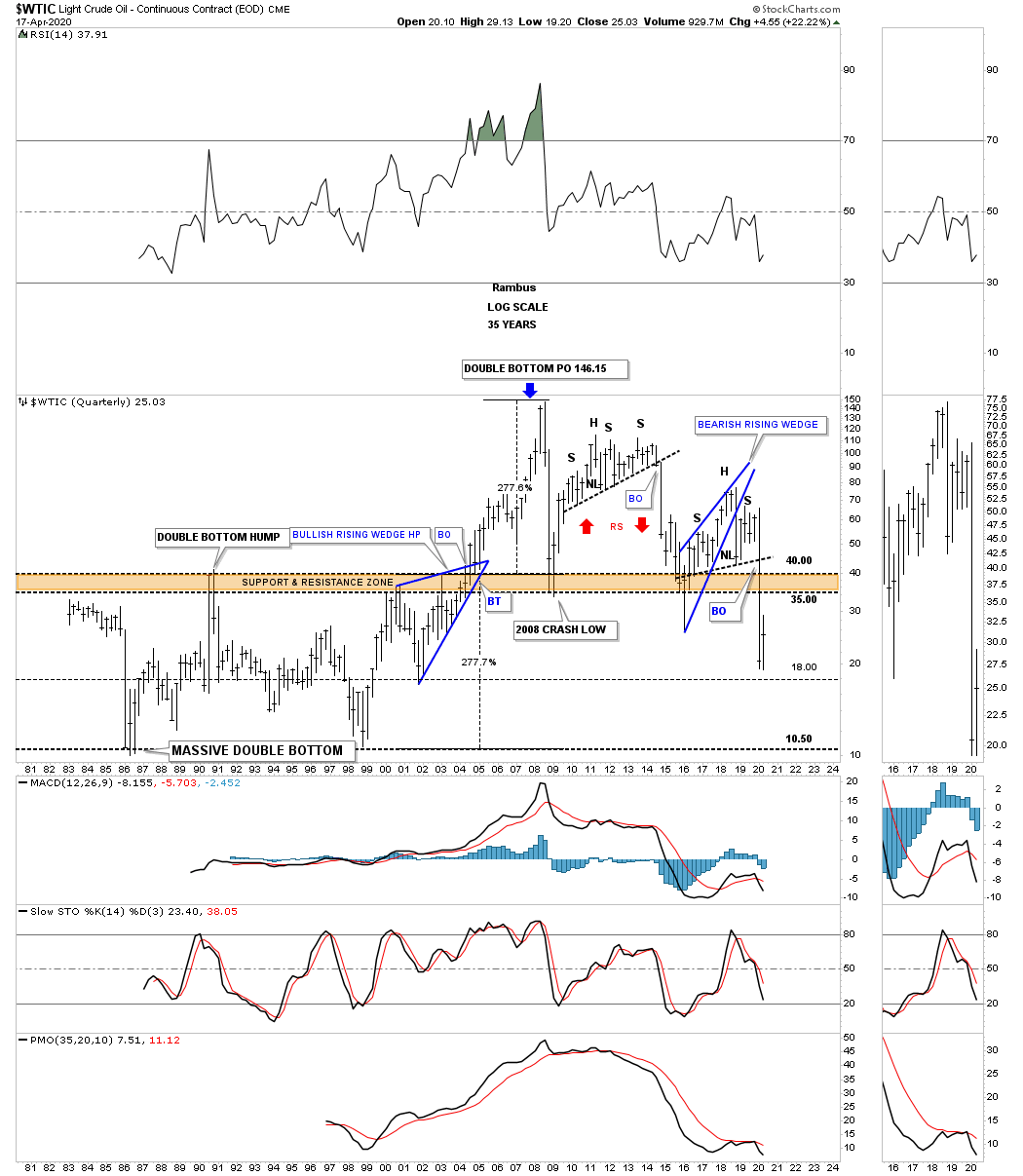

One of the most important commodities on the planet is oil, WTIC. Since the parabolic move that ended at the 2008 high WTIC has been in a severe bear market going from 147 to the recent low just under 20. What is most interesting about this long term monthly chart is how the recent low came in at the H&S measured move price objective down to the 23.19 area which was also the bottom rail of the 2008 downtrend channel. I’m keeping a close eye on the shorter term daily chart looking for some type of reversal or consolidation pattern to form.

Just like the long term quarterly chart for the CRB index we looked at earlier the WTIC has a very similar pattern that goes all the way back to 1981 when the low in oil was 10.81. Note the massive double bottom which projected a move of 277% which was just a dollar or so off the all time high. I’ve often explained what a classic H&S top is. They start out with a rising wedge where the left shoulder and head form inside of the rising wedge with the right shoulder high forming close to the breakout point on the backtest to the bottom rail of the rising wedge. The short oil trade was our best performing leveraged trade during the 2020 crash.

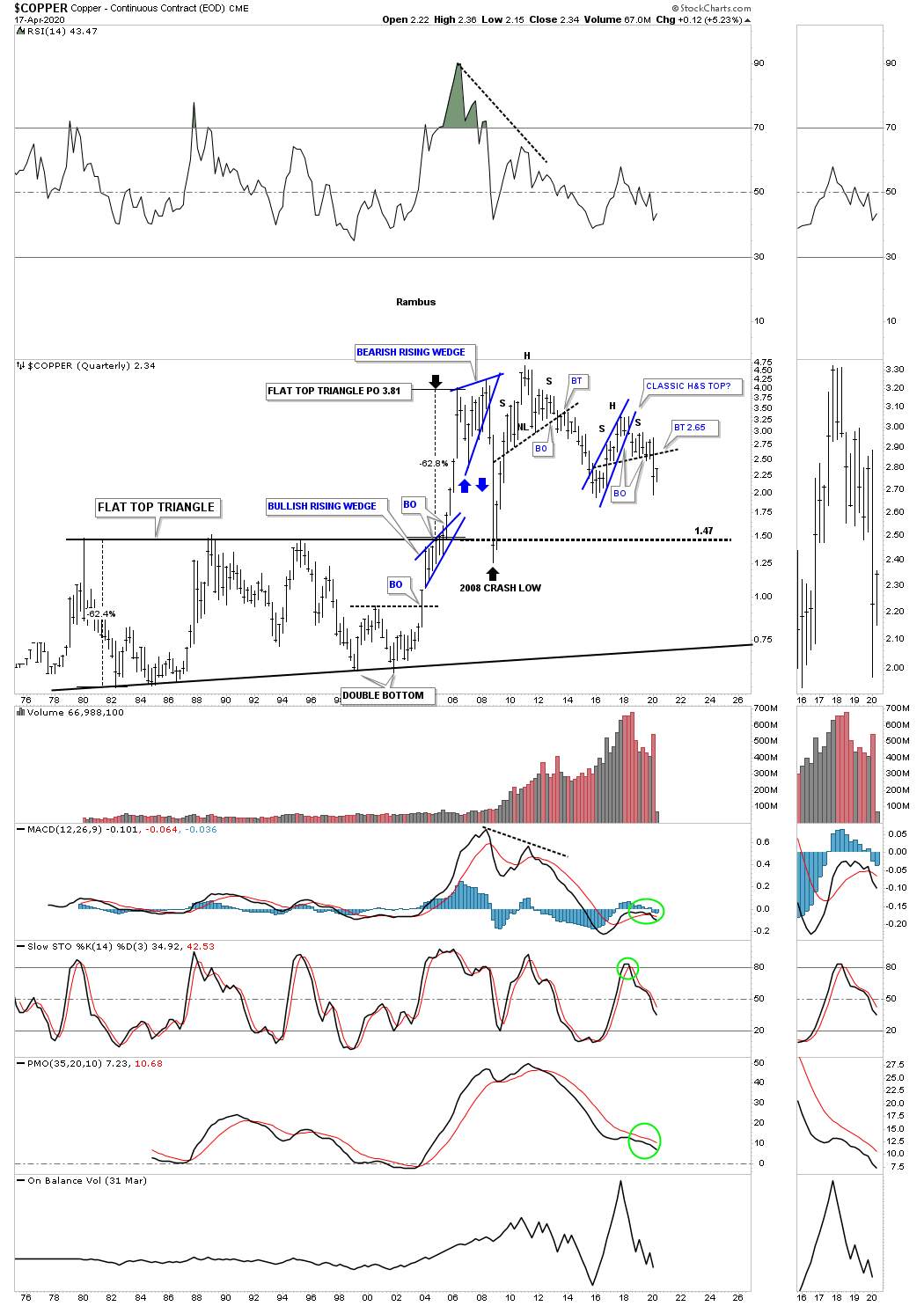

Since we are looking at long term quarterly charts for commodities we shouldn’t be surprised that many have similar looking charts. This long term quarterly chart for Copper shows a similar look to the WTIC which shows its recent H&S top is also a classic H&S top. You can also see the massive base that began to develop back in the late 1970’s which broke out to the topside in the middle of 2005 and reached its price objective at 3.81. Note how the 2008 crash found support right on top of that massive flat top expanding triangle.

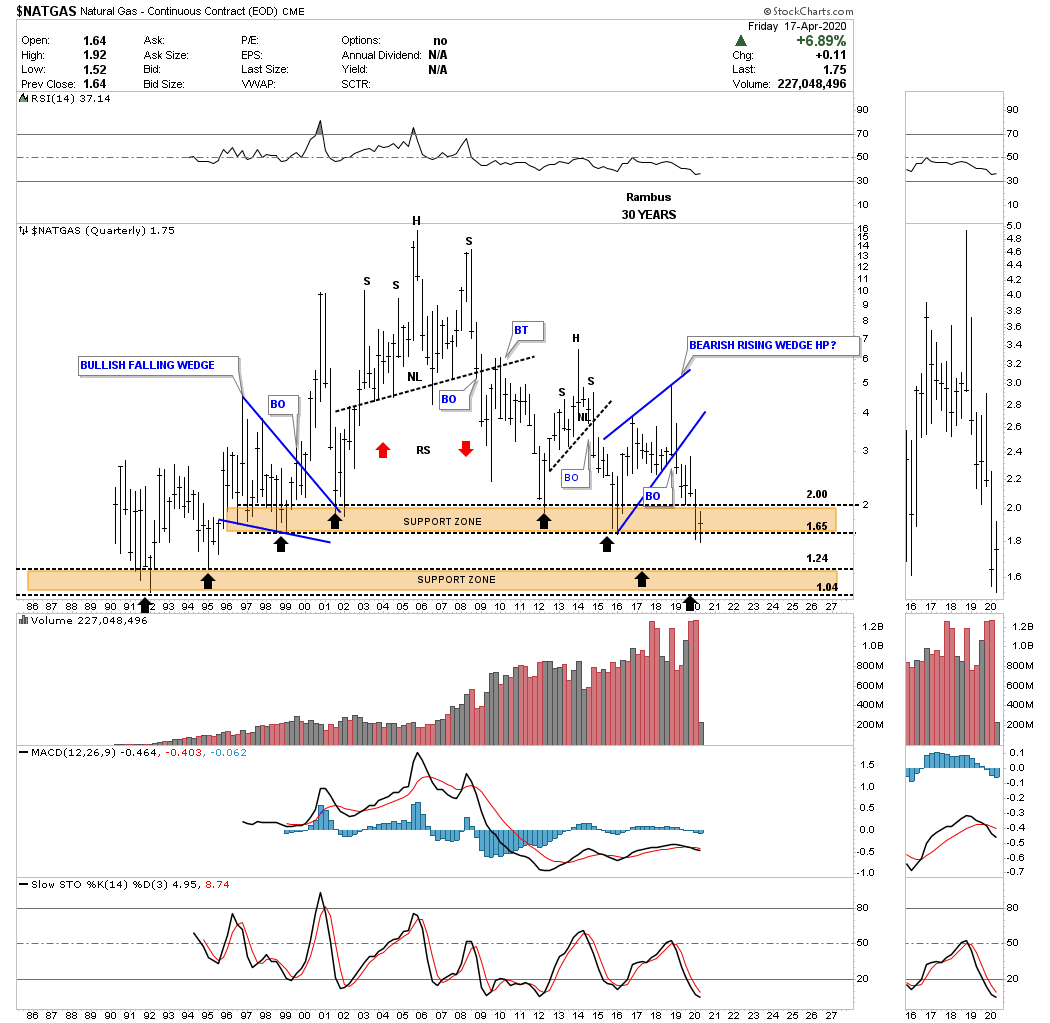

NATGAS, natural gas, is setup a bit differently in regards to its long term chart. The bear market for natural gas actually began in 2005 and has made a series of long term lower highs. When I first built this chart I put in two brown shaded support and resistance zones as the reverse symmetry was playing out so beautifully as shown by the back arrows. The upper brown shaded support zone has held support going all the way back to 1995. Is it going to hold support in 2020?

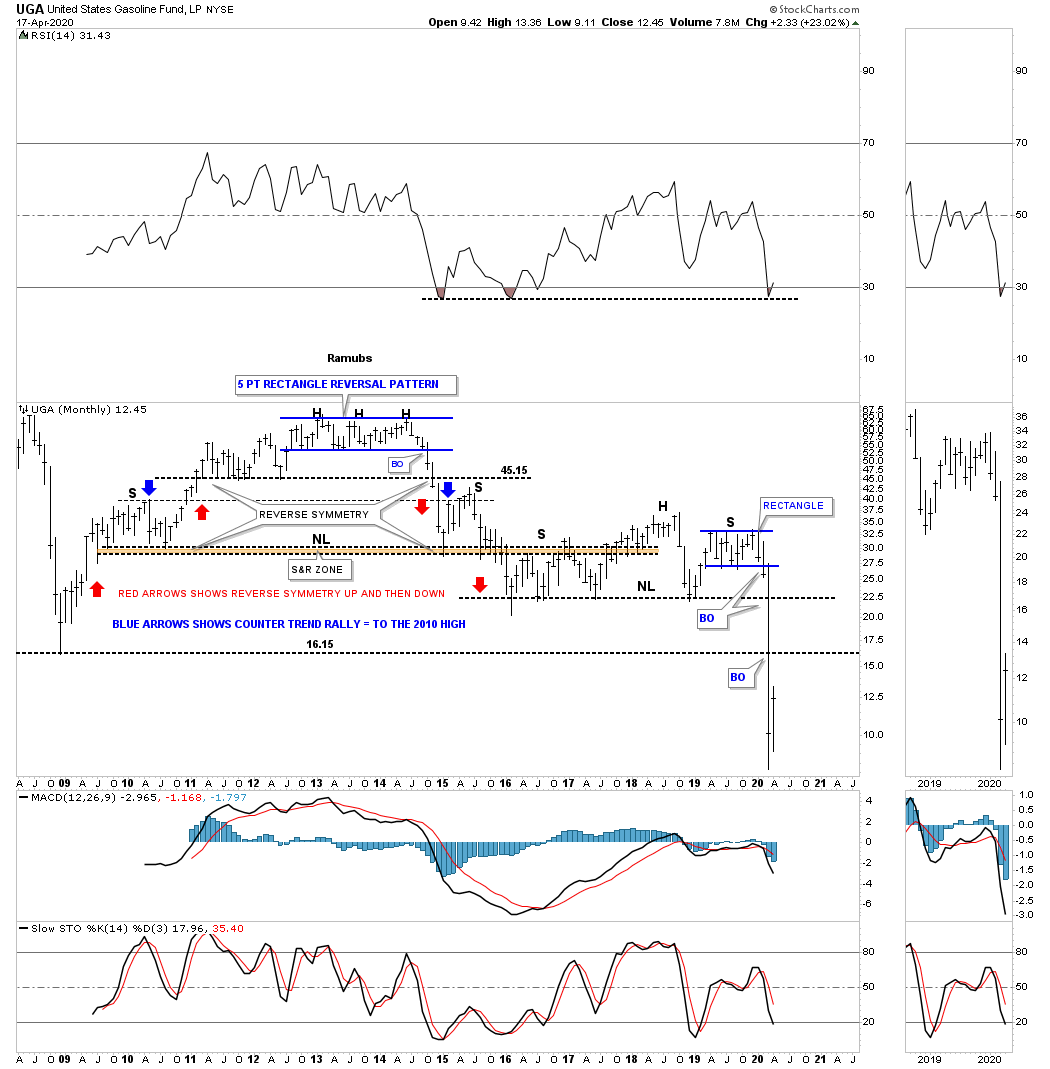

When we first opened up our doors at Rambus Chartology I would show this chart for UGA, gasoline, on Friday night after the market closed for the weekend. The trading range at the top of the chart ended up being a 5 point rectangle reversal pattern which ended up being the head for multiple H&S tops.

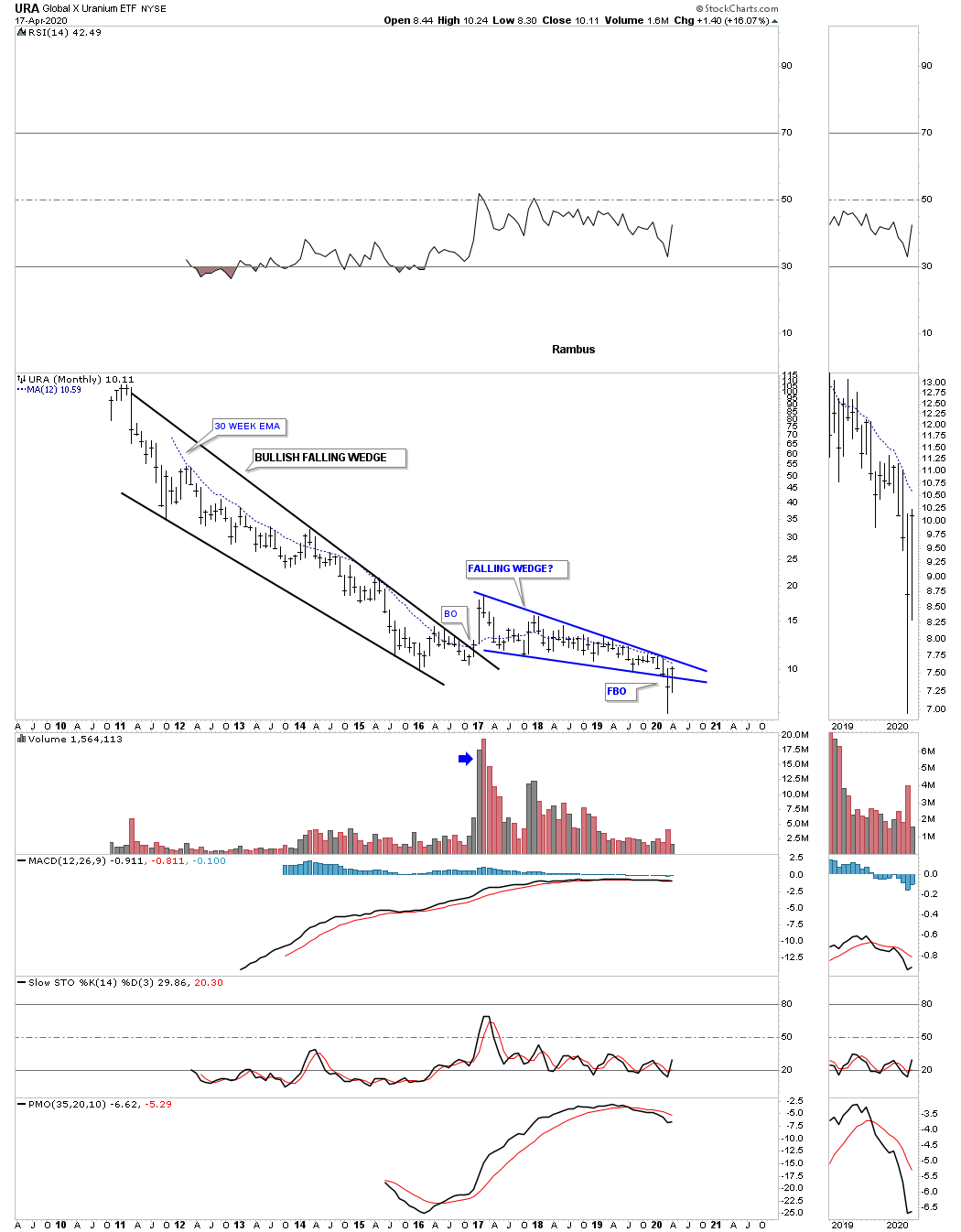

Lets finish up by looking at some different commodities and indexes. Last month the URA broke below the bottom rail of its 2016 falling wedge. So far this month the URA has managed to rally back up into the falling wedge negating the breakout for now. A move above the 30 week ema would help with a bullish outcome which is just overhead.

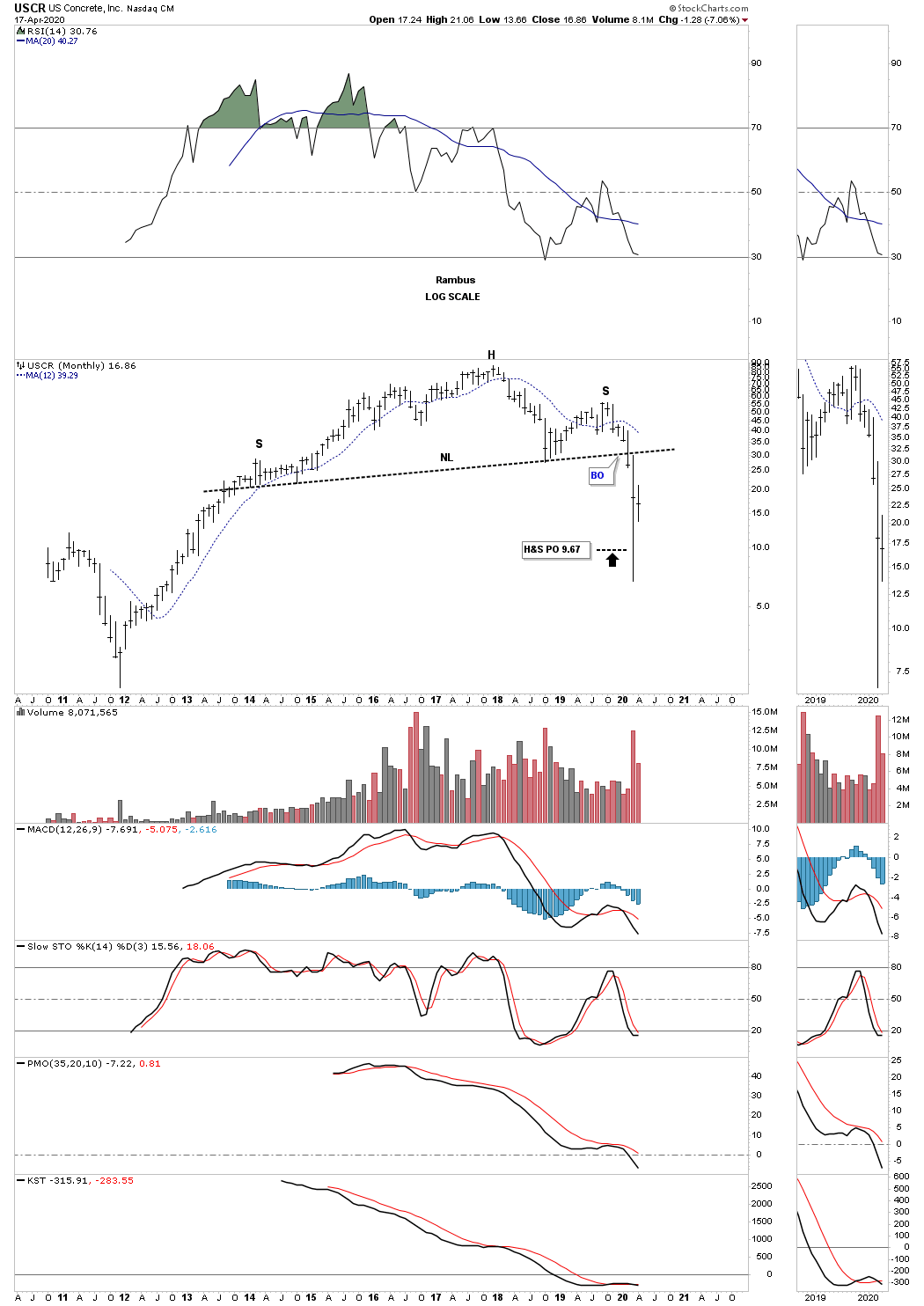

USCR, US concrete, has just achieved the minimum price objective for its H&S top after its massive bull market that began in late 2011.

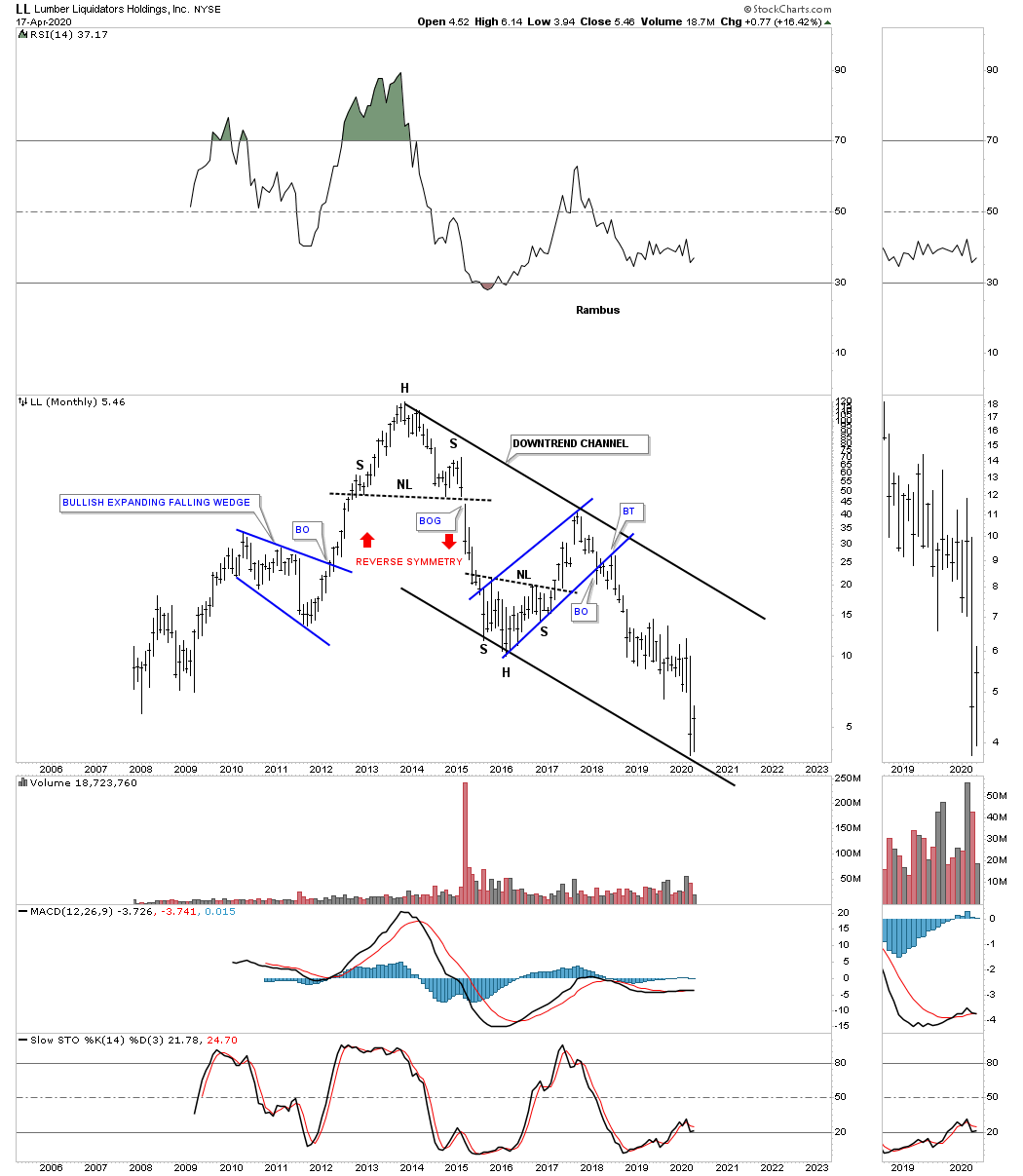

LL, lumber, has just hit the bottom rail of its 2013 downtrend channel.

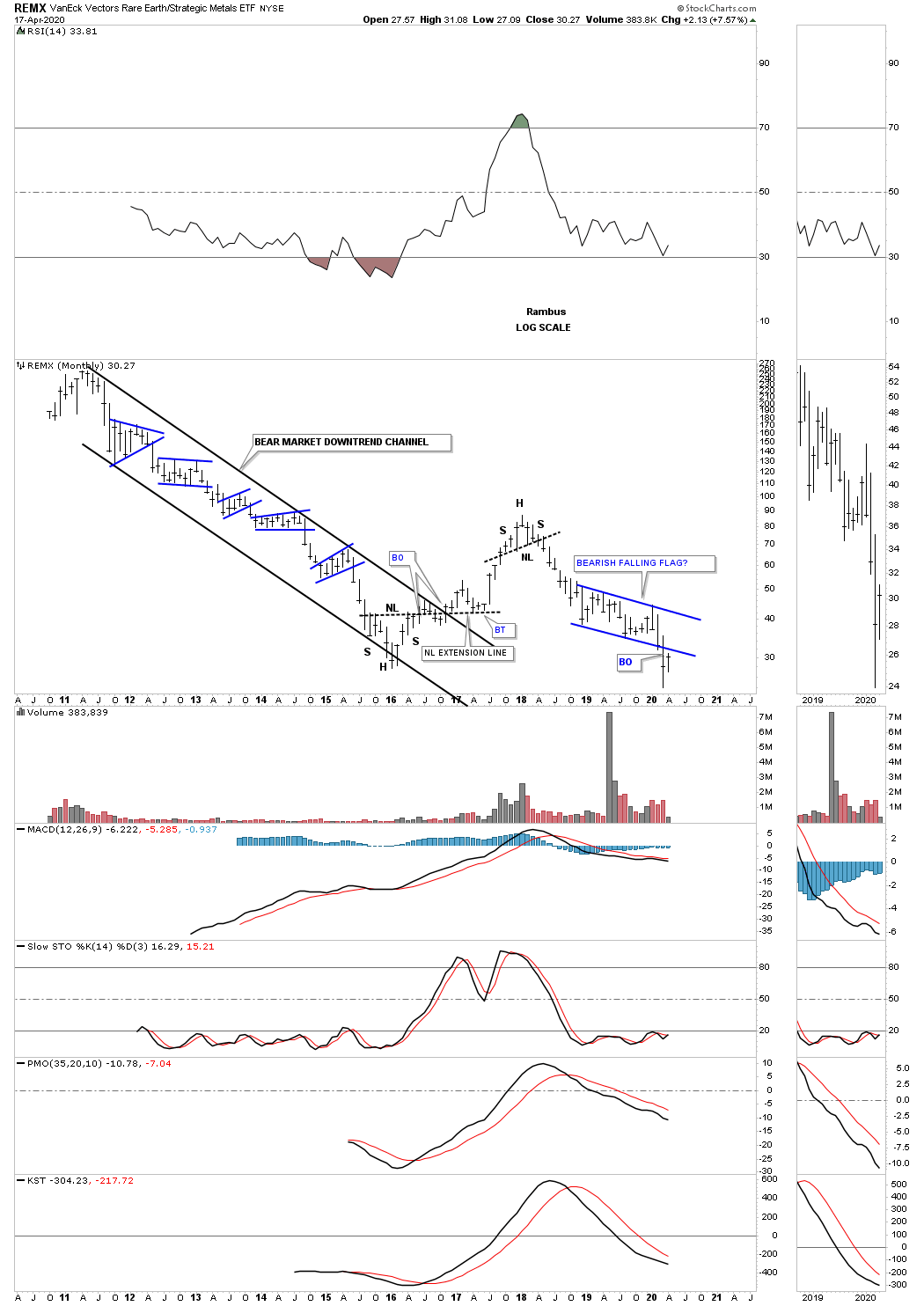

The REMX, Rare Earth etf, has experienced one countertrend rally during its lifetime going back to the 2011 high. Last month the price action broke below the bottom rail of a falling flag formation which is generally a bad sign unless the bulls come to the rescue and rally REMX back into the falling flag at a minimum.

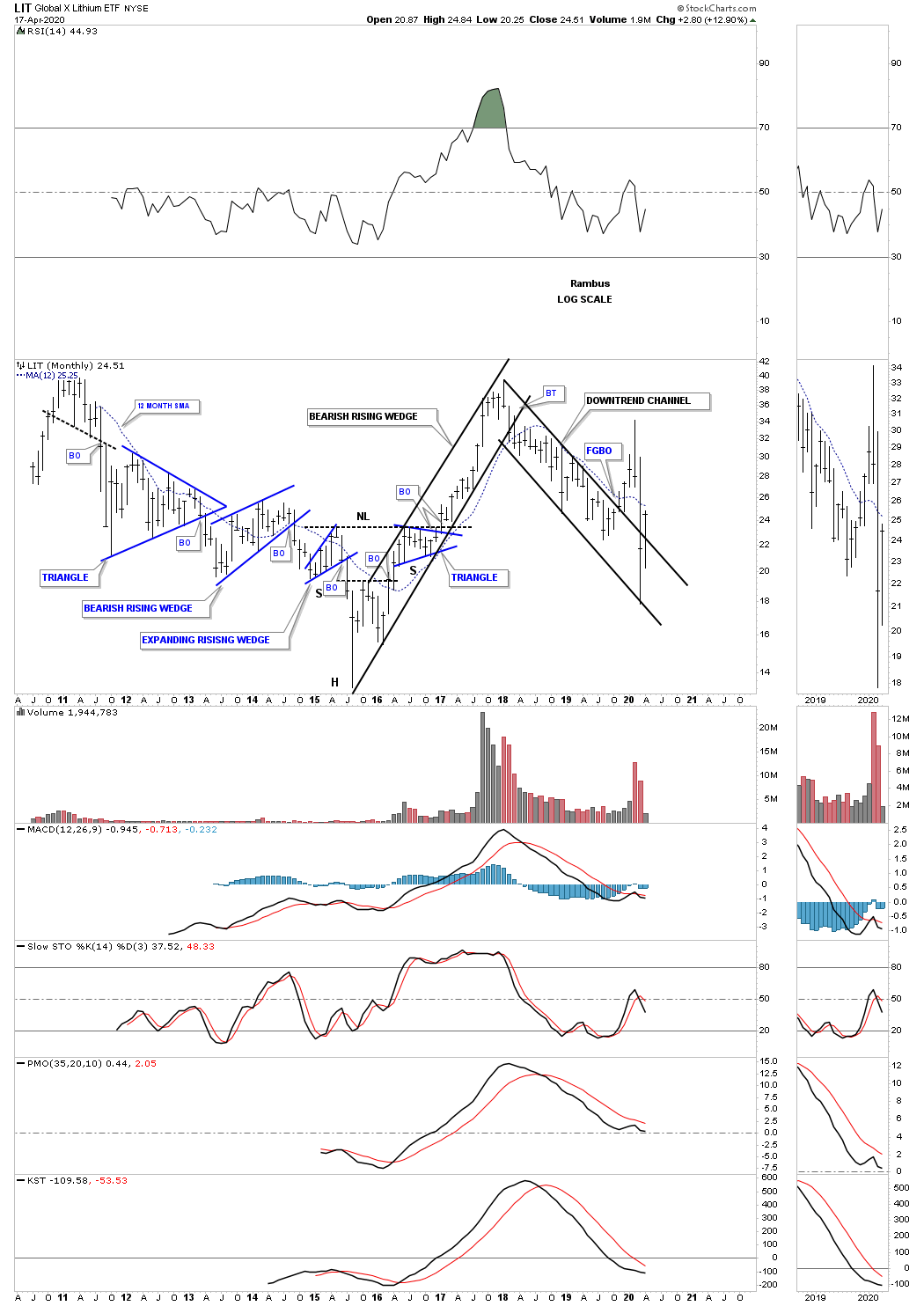

After putting in a false breakout gap last November the LIT, lithium etf, the price action negated that breakout when it traded back into the downtrend channel. This month the LIT is attempting to breakout again trading back above the top rail.

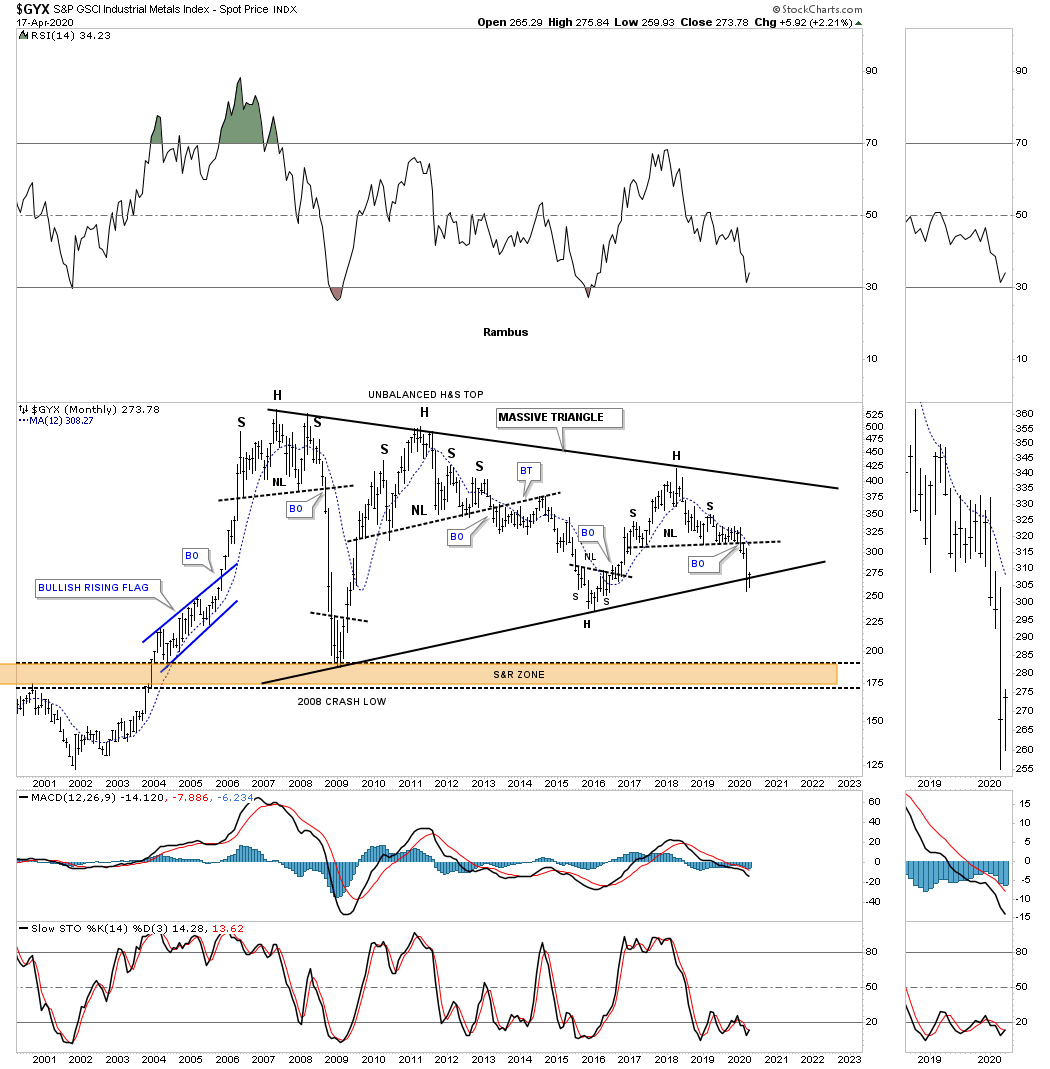

The GYX, industrial metals index, is trying to find support on the bottom rail of its massive 2005 triangle.

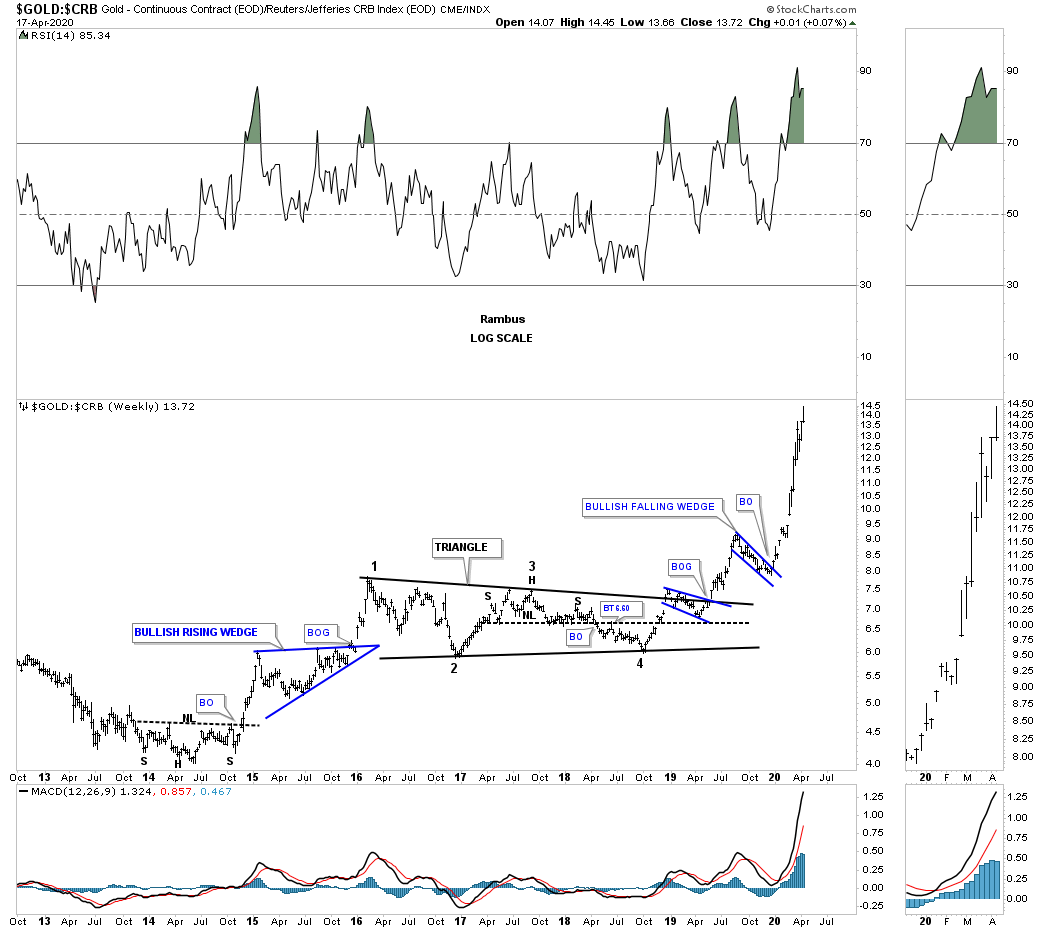

Below is a ratio chart that compares gold to the CRB index. How much longer can gold outperform the CRB index in such a big way?

This last chart for tonight is a long term monthly chart for gold with the 2013 golden neckline. This month the 2013 H&S consolidation pattern minimum price objective has been met a 1791.

The bottom line is that most commodities have been in a bear market since their 2008 highs. Now most have reached their minimum long term price objectives which puts them at a critical inflection point where they can form a consolidation pattern to the downside which would most likely complete their bear markets. On the other hand they could be either starting to form a reversal pattern of some kind which could end their bear markets. Keep an open mind watching the shorter daily charts to see what kind of pattern builds out.

Stay safe and all the best…Rambus

Related Reading:

- Rambus: Blockbuster Chartology – January, 2020

- Rambus: Blockbuster Chartology – October, 2019

- Rambus: Blockbuster Chartology – July, 2019

- Rambus: Blockbuster Chartology – April, 2019

- Rambus: Blockbuster Chartology – January, 2019

- Rambus: Blockbuster Chartology – October, 2018

- Rambus: Blockbuster Chartology – July, 2018

- Rambus: Blockbuster Chartology – April, 2018

- 2017 Annual Wrap Up – Does Your Pension Fund Have A Deep State Drain? – January, 2018

- 1st Quarter Wrap Up 2018 Web Presentation

- Blockbuster Chartology with Rambus – October, 2017

- Blockbuster Chartology with Rambus – July, 2017

- Blockbuster Chartology with Rambus – May, 2017

- Blockbuster Chartology with Rambus – January, 2017

- Blockbuster Chartology with Rambus – October 20, 2016

- Blockbuster Chartology with Rambus – July 21, 2016

- Blockbuster Chartology with Rambus – April 21, 2016

- Rambus: Are We in a Deflationary Spiral? – January 28, 2016

- The Dollar, Gold & the S&P 500 with Rambus – October 15, 2015